Why Do You Need a KYC Solution?

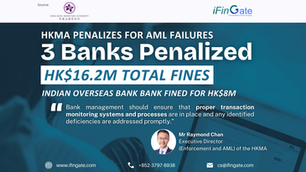

The importance of eKYC have been increasingly recognised from financial institutions. It has been seen as a crucial process to protect against financial fraud, terrorist financing, and money laundering. AML services involve gathering essential customer identities and analysing information of clients. Regulators have always been upholding the need of KYC in HK, and have been imposing strict penalties on organisations that are not complying with eKYC regulations. This reinforced the trend of companies investing in an AML solution for advanced financial transaction surveillance with eKYC companies. While the financial industry faces significant challenges due to the vast amounts of data requiring eKYC processing, further complexities arise from the diverse variety and lack of a standard format in AML service needs. Therefore, the market demands sophisticated AML solutions from KYC companies in Hong Kong.

Exceeding the Market Standard of eKYC

As a KYC solution company, our data helps clients reduce risk by providing a means by which to identify customers with solid background clearance. Most companies in the industry have implemented AML service with account monitoring mechanisms to guard against financial fraud, money laundering, and terrorist financing with their partnering KYC company. As a AML service provider, iFinGate helps our clients achieve the highest standard in eKYC, including: - Customer due diligence process with our AML service that aligned with FATF and BCBS guidelines to verify identities and assess risks. - Ongoing monitoring with our AML solution of transactions for suspicious activities. - Risk-sensitive approach to identify and mitigate money laundering risks. - Training and awareness programs for staff to recognise and report AML risks with AML solution. Meeting these standards in eKYC helps build customer trust and ensures the institution’s reputation and competitiveness in a regulated financial market. A reliable KYC company also supports transparency and timely reporting, addressing increasing regulatory scrutiny effectively. Overall, using a reliable AML service to handle with eKYC process is essential for maintaining confidence and safeguarding the financial ecosystem per market expectations.

KYC Solution that harness the Power of AI

Big Data

In-Built

Compliance Automation

GenAI

How our

eKYC Solution Works

Traditionally, sophisticated KYC and AML providers supply extensive adverse media screening against sanctions, PEPs, and wanted lists. The process of verifying which alerts truly belong to a client, however, is typically manual. In the digital transformation era, iFinGate offers a one-stop, integrated solution that automates the entire workflow—from extracting client credentials from identity documents to delivering results with different match levels, freeing compliance teams from manual tasks.

Our eKYC Solution

Revolutionising AML Compliance: Empowering Industries with AI-empowered Solution

While the need of Anti-Money Laundering (AML) is shared across industries, banks face unique challenges compared to other industries with higher requirement from the size of the data base to the data accuracy. While banks deal with a vast volume of complex financial transactions, it makes their AML compliance requirements more intricate. An integrated RegTech solution that specifically tailored for banks is crucial. Software service provider like iFinGate offers advanced capabilities such as real-time transaction monitoring, risk assessment, automated KYC and AML checks, and regulatory reporting tools. By harnessing the power of RegTech, banks can efficiently detect and prevent money laundering. Complying with stringent regulations, and safeguard their operations while minimising costs and improving operational efficiency.

Advantages of Going Digital

with our eKYC Solution

Transitioning to a digital KYC process offers significant advantages by enhancing both efficiency and security. It dramatically speeds up customer onboarding through automation, reducing verification from days to minutes. This not only improves the user experience but also strengthens risk management; advanced algorithms and AI-powered checks are more effective at detecting sophisticated fraud and ensuring ongoing compliance than traditional, manual methods. Ultimately, going digital on KYC transforms a compliance obligation into a competitive edge.

Manage risk, minimise fraud, and monitor supply chain from the corresponding KYC company.

Minimise Fraud & Risk

Real-time access to the most comprehensive and up-to-date global eKYC information for credit decisioning and reporting for complex account portfolios.

Adapt to Global Solution

An automated and comprehensive end-to-end eKYC solution with compliance and onboarding activities supporting by a KYC solution company.

Automate Data

Analysis Compliance

While big data programmes for KYC HK might seem like a hefty investment at the front end, iFinGate as a KYC solution company uses big data analytics for clients that could drive down the cost of AML compliance solutions operations. iFinGate facilitates in detecting inefficiencies in customer identification, reducing risks of identity theft and money laundering, and increasing customer satisfaction in different functional operations within the institution.

Reduce Cost and

Improve Efficiency

Key Features of our

Digital Client On-boarding Workflow System

Comprehensive Global Coverage

Over 50,000 near real-time update on global data sources, over 200M data from Greater China, and 200+ regions coverage, iFinGate offers professional users a holistic view on market data.

Daily On-going Monitoring

We are proud of our 24/7 monitoring with 'Daily Alert Report' on clients' possible new matches on AML name screening. This proactive monitoring helps companies stay compliant with regulations, reduce risks of money laundering, and respond quickly to potential threats, thereby protecting their reputation and ensuring operational integrity.

Intelligent Automation

iFinGate's eKYC system integrates with AML name screening and automated ongoing monitoring for the best AML service. As a KYC solution company, we offers auto-justification for level of risk assessments, with pre-set high risk parameters & auto-EDD, as well as automatic CDD review cycle alerts.Three Steps Client On-boarding Workflow System

Our AML system helps companies by making the onboarding workflow faster, smoother, and more accurate. Working with an AML solution provider is important, as it allows businesses to quickly and confidently verify new customers, stay compliant with regulations, reduce errors, and provide a better overall experience. With support from a reliable KYC company like iFinGate, we facilitate an efficient onboarding saves time and resources while ensuring the company meets legal requirements and builds trust with clients.

Step 1

Automated Identity Verification (IDV)

iFinGate, as a reliable eKYC company, our identity verification system works by first capturing a user's government-issued ID document and a live selfie. Our IDV function then automatically analyses the ID for authenticity using security features like holograms, while advanced software extracts the printed data. Simultaneously, it verifies the user's live presence through "liveness detection" and compares their selfie to the photo on the ID using facial recognition technology. With support from AML company like us, our end-to-end process confirms both that the document is genuine and that the person presenting it is its legitimate owner, all within a matter of seconds.

Step 2

AML Name Screening

As your trusted AML compliance service provider, iFinGate offers a robust system designed to detect and prevent fraud around the clock. Our advanced GenAI technology continuously monitors transactions and activities 24/7, issuing real-time alerts whenever suspicious behaviour is identified under various risk conditions. As an AI-driven AML service provider, we utilise intelligent engine that evaluates alerts and assigns relevance-based match levels. This effectively filters out non-pertinent alerts and reduces the need for time-consuming manual screening. Beyond alert generation and review, AML compliance solution provider like iFinGate, provides comprehensive background clearance. This includes global sanction screenings, checks against worldwide Politically Exposed Persons (PEP) lists, and exhaustive searches for adverse records. Additionally, we provide targeted litigation and adverse record screening specific to key jurisdictions such as Hong Kong, China, Taiwan, and Singapore, enabling you to meet regional regulatory requirements with confidence.

Step 3

Customer Due Diligence

Customer Due Diligence (CDD) is the foundational process of doing eKYC procedure. Building a complete client profile by gathering and verifying information helps develop a deeper understanding of a client's background and business nature when doing eKYC. This profile is then dynamically enriched and analysed by leveraging AI-powered tools, which cross-reference the collected KYC HK data against global AML/CFT databases, watchlists, and adverse media screening results. With support from eKYC HK service provider like iFinGate, our AI synthesises these findings to automatically generate a final, data-driven risk level (e.g., Low, Medium, or High) for the client. Furthermore, the system intelligently recommends a corresponding ongoing monitoring schedule by proposing a specific upcoming review date, ensuring compliance resources are allocated efficiently based on the calculated risk.

Market Leading eKYC Company

Many eKYC solution providers primarily cater to banks and other financial institutions (FIs). However, KYC solution company like iFinGate, go beyond the norm by offering an all-inclusive risk and regulatory compliance management platform specifically designed for the financial industry. The ever-evolving KYC Hong Kong landscape of regulations, issued by eKYC supervisory authorities worldwide, often overwhelms banks and FIs.

Our AML service is tracking different types of fraud proficiently

The most common ‘individual’ initiated frauds that could be detected through eKYC process would be when a single person is targeted by a fraudster — including identity theft, phishing scams and “advance-fee” schemes. As an eKYC solution providers, we are always ready to go against any type of money laundering actions.

Awards & Recognition

as KYC Solution Company

Our AML Company Partners

Get Free Demo from Our AML Solution Provider Today

Contact us to schedule a real-time and interactive demonstration of our in-built compliance automation system and other products today.

Click here to reserve your demo session, or contact us at (852) 3797-8938 / cs@ifingate.com